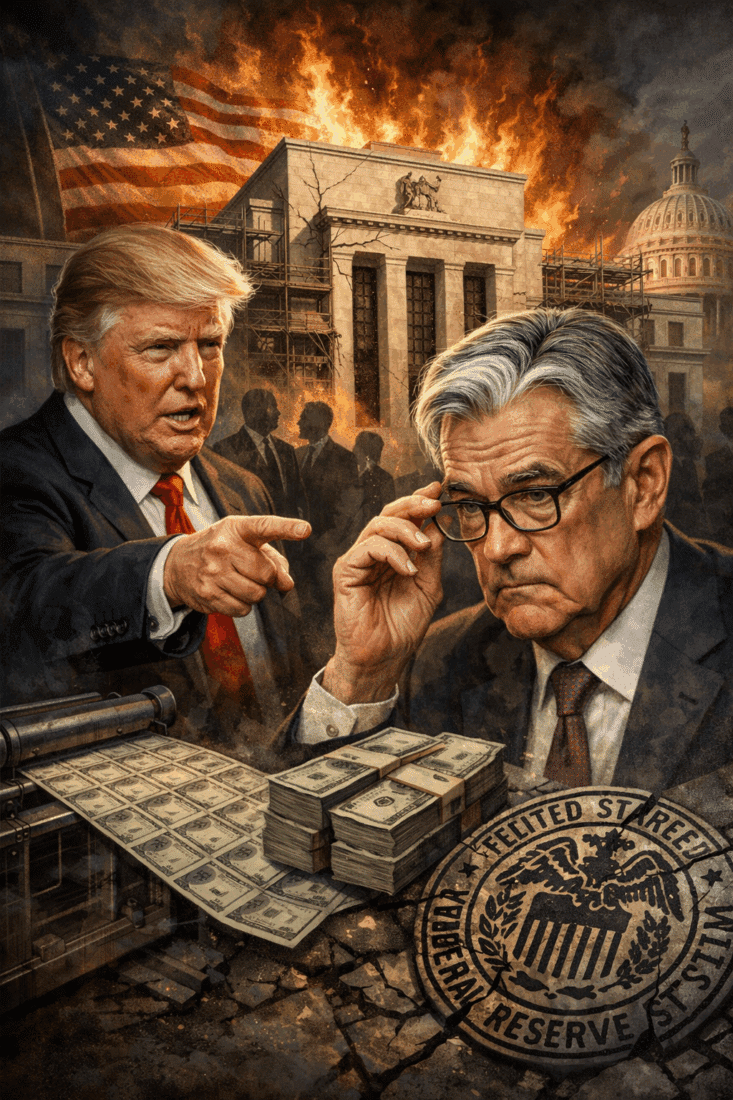

BRICS Delivers Another Gut Punch to the US Dollar as Trade War Tensions Explode

The Dollar’s Death Spiral Accelerates

The global chessboard is shifting—and the U.S. dollar is losing its queen.

With the ink barely dry on the latest “America First” tariff offensive, the greenback has taken another dive. While the corporate press tries to sell this as routine market turbulence, the reality is far more alarming. This is a symptom of a collapsing empire, propped up by debt, hollowed out by decades of mismanagement, and bled dry by endless interventionism.

BRICS: From Bystanders to Architects of a New Order

The BRICS bloc—Brazil, Russia, India, China, South Africa, and a growing cadre of allies—aren’t just watching from the sidelines. They’re building a parallel financial architecture. Their push to de-dollarize isn't posturing anymore—it's a tactical maneuver. And every new sanction, every new tariff from Washington only accelerates the death spiral of the dollar.

The Markets Don’t Lie

Despite a brief uptick on Monday as the dollar bounced off oversold territory, it’s still languishing near a three-year low against the euro and the yen. Market watchers aren’t just nervous—they’re eyeing the exits. Who can blame them? In an environment where gold is surging past $3,200 and fiat currencies are being weaponized, trust in the dollar has become a liability.

Gold: The BRICS Currency of Choice

BRICS, on the other hand, is quietly stacking gold like it’s the lifeboat off a sinking ship. They’re building payment systems, forging bilateral trade deals, and testing settlement models that bypass SWIFT entirely. Meanwhile, the U.S. is doubling down on a surveillance economy built on digital compliance tokens like FedNow. The contrast couldn’t be starker.

Trust in the Dollar Is Evaporating

Adam Button of ForexLive nailed it: “The uncertainty is now at an intolerable level for most businesses in international trade.” Translation: the world’s getting tired of playing ball with a currency that’s increasingly volatile and politically toxic.

The Empire is Crumbling from Within

Remember—dollar dominance was once considered untouchable. But what we’re witnessing now is the slow-motion collapse of a financial regime, undermined not by outside enemies, but by the very institutions tasked with preserving it.

This isn’t just economic policy. It’s economic entropy. And BRICS is betting the house that a post-dollar world is closer than most Americans realize.

Take Back Control Before It’s Too Late

The writing’s on the wall, and it’s scrawled in red ink. The dollar is dying. BRICS is rising. And digital tyranny is waiting in the wings.

Download “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius now before your financial freedom is the next casualty.

👉 Download Here

Stay sharp. Stay sovereign.