Gasoline Prices Are Poised for a Ruthless Surge

Oil prices rallied for the second straight day, reaching their highest since April, on "price-supportive rhetoric" from the OPEC and its allies, said Tyler Richey, co-editor at Sevens Report Research.

The initial "knee-jerk selloff" reaction to the June 2 decision by OPEC+ to phase out voluntary oil-production cuts after the third quarter was "largely reversed and seen as overdone," Richey told MarketWatch.

OPEC+ leadership "confirmed that they will remain flexible and only reduce their voluntary output cuts if market conditions warranted, and clarified increasing production is not necessarily a base-case expectation right now," he said.

"Evidence of strong domestic demand at the start of the U.S. summer driving season, rising geopolitical tensions overseas and renewed hopes for a perfectly executed [economic] soft landing" by the Federal Reserve have also contributed to oil's price rebound, Richey said.

Tonight's API data is all we have to go on until Thursday (since tomorrow is a market holiday)

API

-

Crude +2.26mm

-

Cushing +524k

-

Gasoline -1.08mm

-

Distillates +538k

Crude stocks rose for the third straight week while Gasoline stocks drew down for the first time in four weeks...

Source: Bloomberg

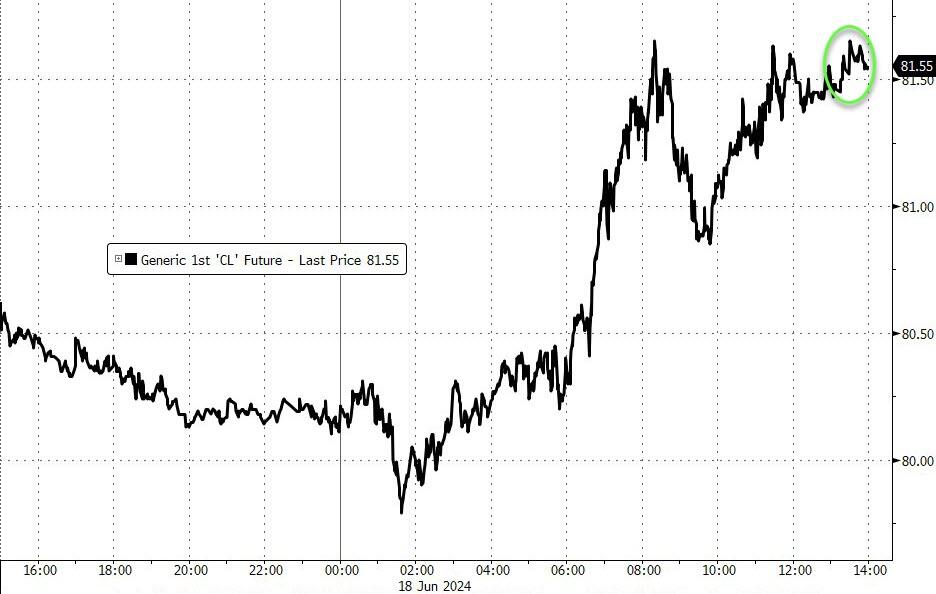

WTI traded marginally higher this evening after the API data...

WTI broke above all of the major technical levels this week...

Source: Bloomberg

Geopolitics "returned as a meaningful influence on the markets in recent weeks, as there has been a resurgence in ship attacks in the Red Sea related to the ongoing Israel-Hamas/Hezbollah conflict," Richey said. Ukrainian drone attacks on Russian oil and energy infrastructure resumed this week, with a strike at a refined-product terminal in Azov resulting in an explosion and sizeable fire at the facility, he said.

Sentiment in the oil market, however, is "fragile," Richey said. "If we see any headlines that contradict any of those factors that have supported the latest rally, or even just an uptick in broad market volatility into the end of the quarter, we could see oil markets correct back towards the mid $70 a barrel range."

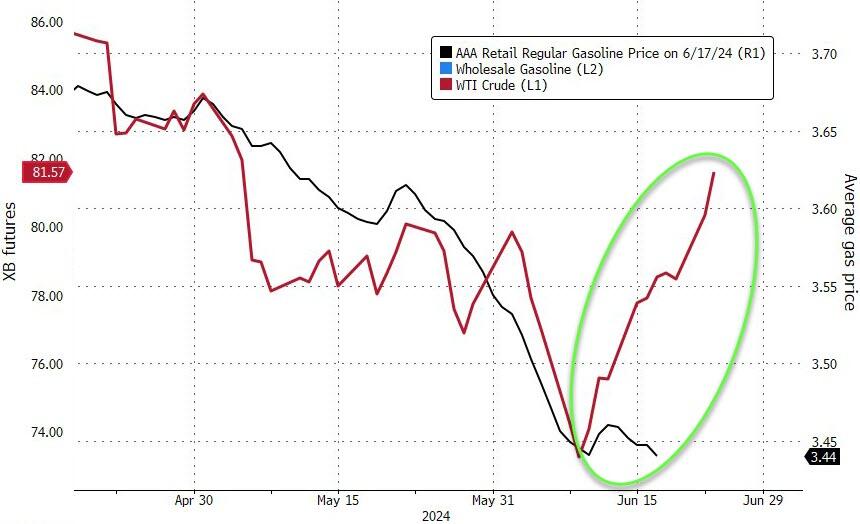

Finally, we note that the disinflation that has buoyed hopes for The Fed's first rate-cut, and helped Biden out, may be about to abruptly stall...

Source: Bloomberg

Of course, we are sure mom-and-pop gas station owners will be blamed though if prices do rise again!

This article originally appeared on Zero Hedge