Here Comes The Wave? Loan Defaults Are At 6-Year Highs

EDITOR NOTE: We’re just beginning to see what some describe as a “biblical wave” of bankruptcies and loan defaults. The devastating effect this will have on the US economy is something that has yet to be seen (but it’s coming, without a doubt). This shouldn’t be surprising. What’s baffling is that many investors have optimistically set their sights on the future without considering the full economic risks and implications caused by the COVID-19 lockdown. No, the Fed or government can’t just snap its fingers and get the economy back to normal. And this article provides a detailed exposition of the insolvency epidemic that’s about to plague the nation (and global economy)--the data we’re seeing to date and what it means for us in the near term.

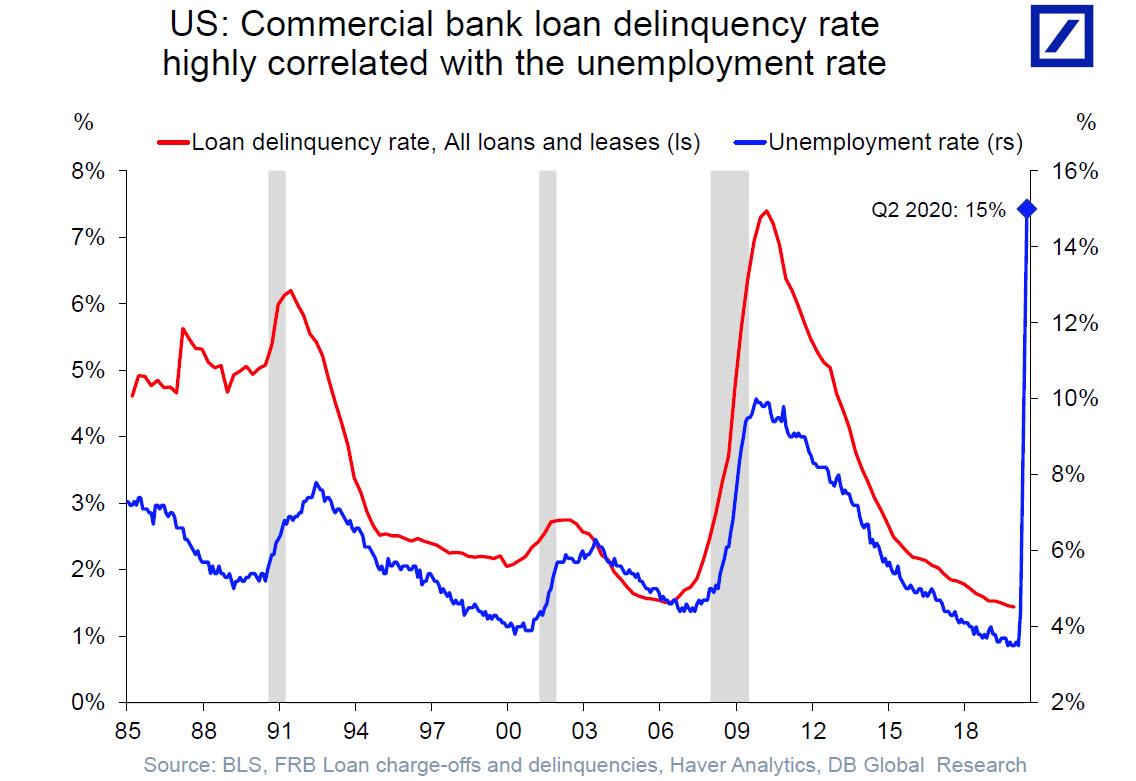

Two weeks ago, when looking at the recent flurry of chapter 11 filings and a striking correlation between the unemployment rate and loan delinquencies, we said that a "biblical" wave of bankruptcies is about to flood the US economy.

It now appears that the wave is starting to coming because according to Fitch, the monthly tally of defaults in the U.S. leveraged loan market has hit a six-year high, as companies are either missing payments or filing for bankruptcy because of the fallout from the coronavirus pandemic.

According to the latest Fitch Leveraged Loan Default Index data, the total amount of defaults in this high-risk, high-yielding area of the debt markets at $12.6 billion in May so far, the highest since April 2014, bringing the leveraged loan default total for the year to date is $33.3 billion.

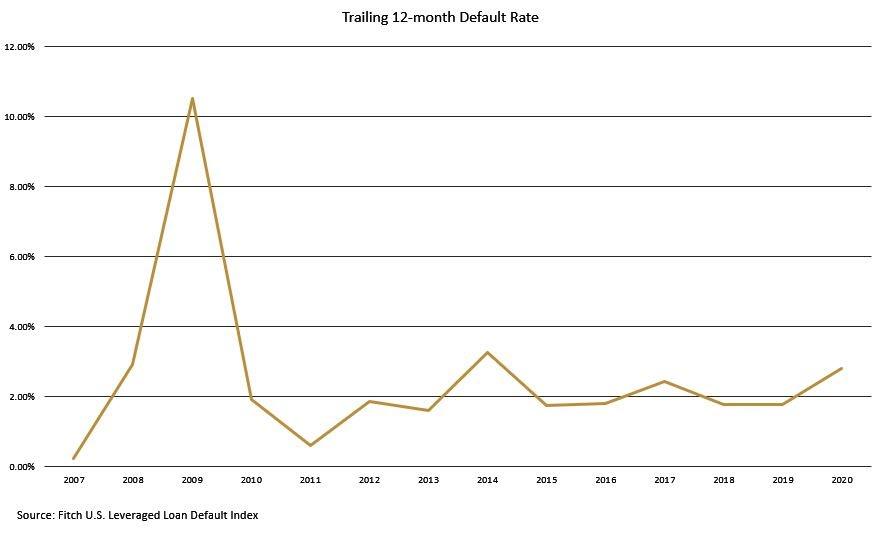

At the end of April, the trailing 12-month default rate jumped to 2.8%, compared to just 1.8% at the end of last year. Fitch forecast that U.S. leveraged loan defaults would reach $80 billion in 2020, surpassing the previous high of $78 billion in 2009.

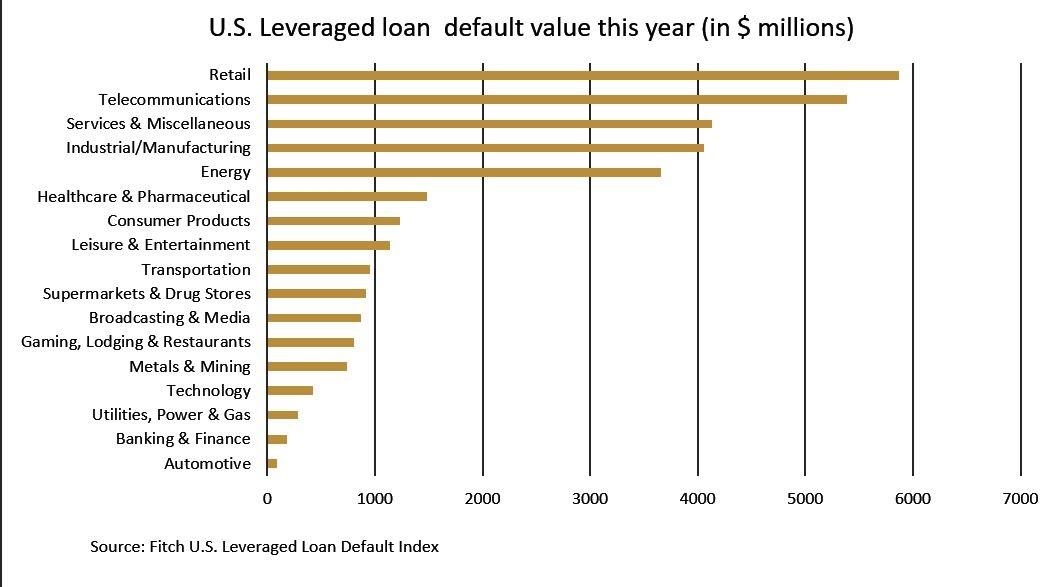

While many expect the US shale sector to lead in the coming default spike, US retailers have accounted for the bulk of defaults over the past two months, as they were forced to temporarily close stores in response to the COVID-19 pandemic. For now, energy remains in 5th spot after the telecom, services, and manufacturing sectors.

Retailers Neiman Marcus Group, J.Crew and J.C. Penney all filed for Chapter 11 bankruptcy protection this month in the United States, while Chesapeake Energy said this month it was unable to access financing and was considering a bankruptcy court restructuring of its over $9 billion debt if oil prices did not recover from the sharp fall caused by the COVID-19 pandemic.

What's coming will be far worse, with none other than the CEO of the world's biggest asset manager confirming as much: speaking on a call with clients, Larry Fink who runs the $7.5 trillion Blackrock, said that bankers told him they "expect a cascade of bankruptcies to hit the American economy."

Originally posted on ZeroHedge

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.