JPMorgan: Is The Surge In Gold A Sign Of Eroding Confidence?

EDITOR NOTE: Versus the U.S. dollar and the British pound, gold prices are through the roof and headed much higher due to incredible deficit spending. Lost confidence in fiat money is at the root.

The past few months have been painful for many FX traders, as a result of a global economic crisis has left the major reserves currencies – USD, EUR, JPY, CHF, GBP – clustered at rate levels between roughly 0% to -0.5%, which doesn’t allow rate differentials to inspire much movement amongst them, and is also one reason a G10 currency index like DXY hasn't moved much during this crisis.

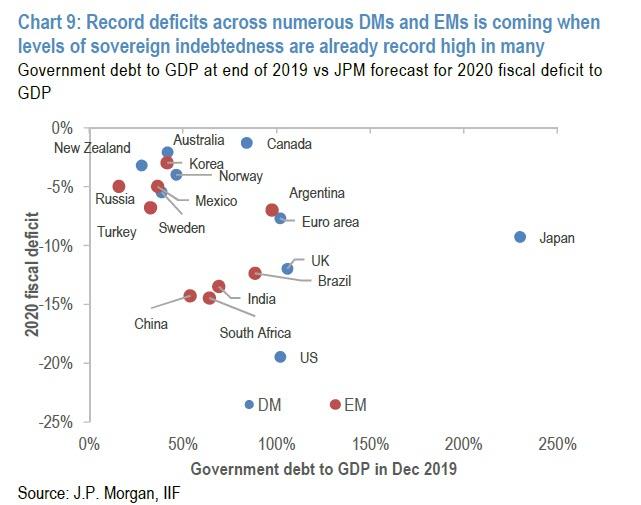

But the lack of dispersion within this bloc shouldn’t be "misread as investor comfort with these reserve assets in an era of record budget deficits from high starting levels of indebtedness, in turn motivating long-term concerns about sovereign risk in Europe and inflation or fiscal irresponsibility elsewhere" as JPMorgan writes in its Weekly Asset View report authored by John Normand.

Indeed, as the bank ominously continues, these background concerns may partly explain why Gold, "which is the world’s legacy reserve asset", has made or is nearing all-time highs versus the euro, yen, sterling, Swiss franc and the dollar (9% from an all-time high) even as the trade-weighted dollar creeps higher.

And while JPM takes a measured approach in qualifying what this move in gold means for the dollar, saying "this isn’t anything close to the dollar crisis that is foretold every few years in response to extreme loose Fed policy or rising twin deficits (fiscal and current account)" explaining that such an "outcome would deliver instead high-volatility USD depreciation versus all reserve currencies due to capital flight", the bank's conclusion is nonetheless disturbing for its brutal honesty:

... instead, take this Gold move as a sign of eroding confidence in central bank-generated money generally, a trend that will probably continue until enough growth returns to put fiscal policy on a more efficient path.

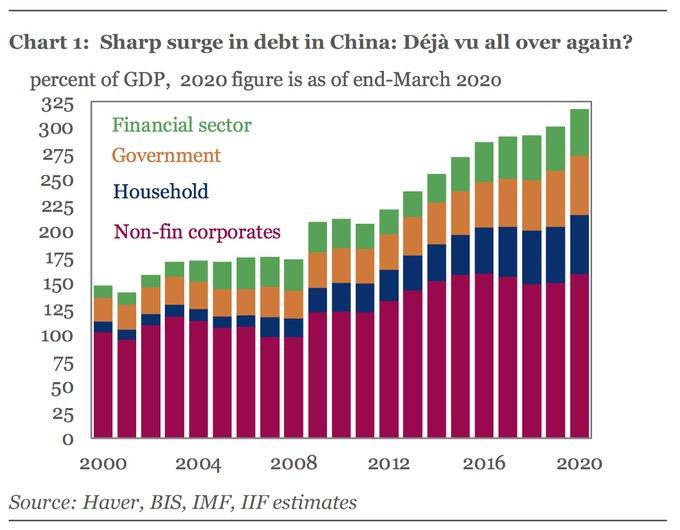

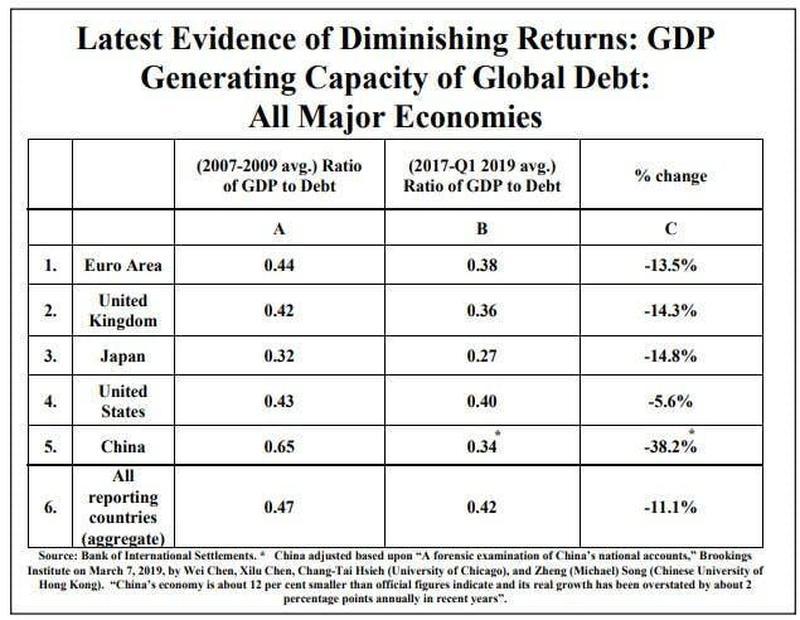

But what is enough growth does not return to put fiscal policy on a more efficient path? What if, instead, the entire world turns into China where the only economic growth comes from flooding the economy with debt, resulting in massive malinvestment and an avalanche of defaults just waiting to begin?

Indeed, what if the world is has crossed the Rubicon where the marginal utility of debt is collapsing and it takes exponentially more leverage to create even the smallest uptick in growth.

What happens to gold then?

Originally posted on ZeroHedge

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.