Manufacturing “Rebound” or Economic Mirage? What the Latest Numbers Really Mean for America’s Industrial Future

The Illusion of Recovery: What the Numbers Actually Say

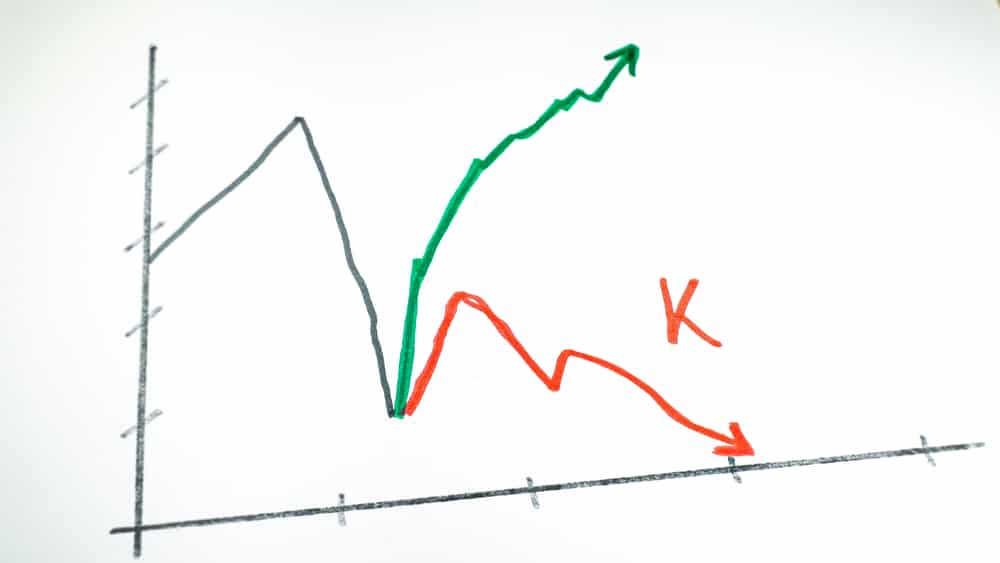

The Institute for Supply Management (ISM) recently reported that U.S. factory activity expanded in January for the first time in a year, with its purchasing managers' index rising to 52.6. That number crosses the symbolic 50-point threshold, which typically signals economic growth. But the real question is whether this is a true Manufacturing Rebound or Economic Mirage driven more by temporary forces than lasting industrial strength.

At first glance, this may appear like a genuine industrial rebound. But if you think the American manufacturing engine is finally roaring back, think again.

A Closer Look: Seasonal Reordering, Not Real Growth

Let’s cut through the noise: January is historically a month of reordering—not fresh demand. The ISM itself admitted that part of the surge came from buyers restocking after the holidays and scrambling to get ahead of expected price hikes tied to lingering tariff pressures.

This isn’t expansion. It’s defensive buying. It’s manufacturers and retailers playing catch-up—not surging forward.

S&P Global Raises the Red Flag: Production Outpacing Sales

The S&P Global index also showed an uptick, with the strongest production increase in nearly four years. But here’s the kicker: production is far outpacing actual sales—a mismatch not seen since the depths of the 2009 financial crisis.

Chris Williamson of S&P Global put it plainly:

“This highly unusual situation is clearly unsustainable... unless demand improves markedly in the coming months.”

This is more than a data point—it’s a warning. Factories are producing goods people aren’t buying. That’s a setup for a supply glut, job cuts, and further industrial slowdown.

The Tariff Trap: High Prices, Low Demand

What’s holding demand back? In a word: tariffs.

These political tools, marketed as patriotic protection for American workers, have instead created a hostile pricing environment. Manufacturers cite consumer resistance to high prices, with tariffs frequently named as the culprit.

This is what happens when government trade policy trumps market forces. The result is distorted pricing, suppressed demand, and fragile production cycles.

Inside the Industry: Reality Doesn’t Match the Headlines

The ISM may paint a picture of optimism, but the boots-on-the-ground comments from actual manufacturers tell another story entirely.

“Buyers continue to stand on the sidelines. Every conversation revolves around hope that the second half of 2026 starts the turnaround,” said one transportation firm.

This isn’t confidence. This is hope masquerading as growth.

The Real Message for Free-Market Advocates

To those of us who have long warned about the dangers of inflationary policy, centralized economic control, and trade manipulation, this “manufacturing rebound” is not a victory—it’s a signal flare.

We’re watching economic distortion in real time—where production becomes disconnected from demand, pricing is dictated by policy, and industry is pinned between optimism and obsolescence.

This is not a sector on the rise. It’s a sector on life support, with government fingers pressing on the scale.

Protect Yourself: Prepare for the Digital Shift and Economic Instability

If these manipulated indicators tell us anything, it’s that you cannot rely on the system to protect your wealth or your future. As production falters and demand softens, the next moves from policymakers will likely involve more intervention, more stimulus, and more centralized control—including digital financial tools like CBDCs, FedNow, and programmable money.

These tools don’t fix the economy. They corral it.

Final Warning: You Must Act Before the System Closes In

If you can see the signs—disconnected production, manipulated pricing, and creeping financial surveillance—you already know what time it is. The clock is ticking, and waiting for the government or markets to "fix themselves" is no longer an option.

Start defending your financial independence now.

Download the Digital Dollar Reset Guide by Bill Brocius — your essential blueprint for surviving and thriving in the new financial regime being built behind the scenes.

Don’t wait until the next contraction to realize your assets were trapped inside a system designed to control you.