Putin's Plan With The New Russian Gold Standard

EDITOR'S NOTE: By forcing its trading partners to transact only in rubles, and by hiking interest rates to over 20%, Russia was able to stabilize its currency to levels hovering just below its pre-invasion range. That’s the first step in bolstering an economy shattered in one fell swoop by western sanctions. The next step, advancing its economy back into the arena of global competition, requires an even more unique proposition that hardly any country offers: a gold-backed currency. Russia’s “5,000 rubles per gram of gold” still has a ways to go before it can establish a new Russian gold standard; one that’s functional and reasonably robust. But despite the early hiccups, we can’t say it’s a bad idea. The author below is right in reminding its readers that “gold is tangentially being utilized to make an existing money more sound.” It’s really one of the few moves that Russia can make, considering it’s been cut off from a wide segment of the western global economy. But what impact might this move have on nations who are looking to stabilize their currency, albeit from a more favorable economic and geopolitical position?

After ten days of offering to purchase gold for a fixed number of rubles, the Russian central bank has announced that going forward it will pay negotiated rates in future purchases of gold in rubles.

On Friday, March 25, 2022, the Bank of Russia announced that it would set a fixed price for gold purchases made with rubles beginning on Monday, March 28th through June 30th, 2022. (Also on March 28, the Russian government further announced that international commodity purchases may no longer be made in dollars or euros, but rather that everything from oil and natural gas to grains and industrial metals must be transacted in rubles.)

At that time, the Bank of Russia stood willing to purchase gold from Russian banks at a fixed 5,000 rubles per gram, which set an effective “floor” on the ruble. At 31.1 grams per troy ounce, with the Russian central bank bidding for gold at 5,000 rubles per gram, one ounce of gold would be purchased for 155,500 rubles.

The Kremlin’s goals are obvious: They seek to force nations to transact in their currency which, owing to a comprehensive and growing array of Western sanctions, had been steeply devalued. They also, by demanding payment in rubles, are attempting to increase demand for their currency while spurning trade in the familiar medium of US dollars.

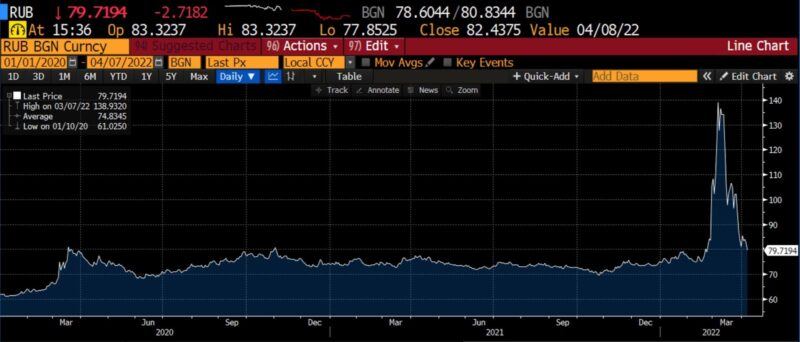

London markets have refused to accept Russian bullion for some weeks now. Nevertheless, the ruble has recovered from its lows of 138.93 to $1 on March 7, 2022 to between 78 and 82 to the US dollar over the last few days. The exchange rate now sits roughly where it was when the invasion of Ukraine began on February 24, 2022. Demand for the ruble to consummate energy and grain purchases, battlefield losses (most notably the Russian forces’ inability to seize Kyiv), and the growing improbability of NATO intervention are moderating rates of exchange for the ruble as well.

RUBUSD exchange rate (2020 – present)

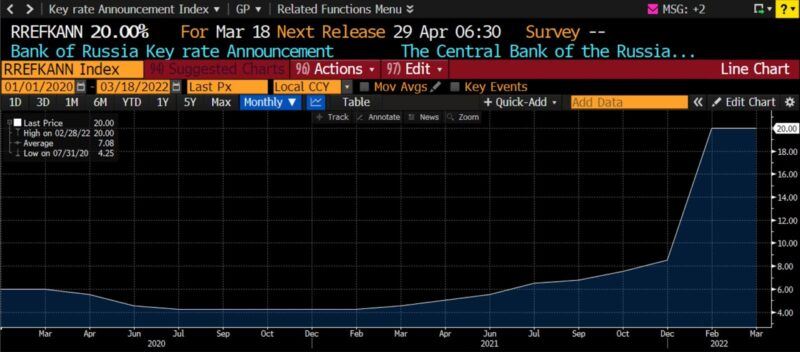

The Bank of Russia’s decision to hike interest rates to over 20 percent, stemming the flow of savings out of Russian banks, has additionally stabilized the financial system.

Bank of Russia key interest rate (2020 – present)

But neither today’s shift nor the original ‘5,000 ruble per gram’ purchase measure constitutes a gold standard despite the enthusiasm of certain media pundits. A bona fide gold standard would require the Russian central bank to both purchase and sell (which is to say, exchange) gold and rubles; and to do so according to a fixed weight or quantity of gold per unit currency.

In the previous arrangement, the effective gold purchase price was at times lower than the world (dollar) price of an ounce of gold, according to Shanghai Metals Market, China’s leading integrated internet platform provider of nonferrous and ferrous metals.

Two weeks ago, Russia’s central bank announced that it would stop buying official gold from local banks because of a surge in demand from ordinary consumers. Russia’s central bank said on Friday [March 25] that it would pay a fixed price of 5000 roubles ($52) per gram from March 28 to June 30, starting this week. This is lower than the current market value of about $68.

Most entities selling gold to the Russian central bank at those prices would only have done so if they were desperate for rubles or unwilling/unable to access above-board gold dealers offering the prevailing world gold price in dollars. Meanwhile Russian citizens have been far more interested in purchasing gold.

One imagines that the new, negotiated gold purchase rates will permit Russian authorities to set rates in line with the motivation of sellers, discounting for immediacy. Further, that nations which are politically friendlier to the Kremlin will receive more favorable purchase terms. It additionally seems likely that among the gold sellers will be entities taking advantage of a rare opportunity for confidential liquidity provision, including elements of organized crime, terrorist groups, individuals with hidden assets and rogue states in particular. There are already indications that Russia is increasingly organizing certain commercial affairs in line with the operation of other pariah states.

Despite the clamor of incorrect headlines regarding Russia’s embrace of gold, it remains a positive step. Gold is tangentially being utilized to make an existing money more sound. It is most unfortunate that these measures are tied to an event as awful as the Russia-Ukraine War, but it may give other nations in less dire circumstances the motivation, and indeed the courage, to shore up their battered currencies.

Originally published on AIER.