Silver Squeeze: Energy Transition Drives Skyrocketing Prices

While the global energy transition requires critical materials such as cobalt, lithium and nickel, silver plays a key role across a range of clean energy technologies, and the market is reflecting this reality, according to Maria Smirnova, Managing partner at Sprott and Chief Investment Officer at Sprott Asset Management.

“Following a year of flat performance (silver gained 0.66% in 2023), thus far in 2024, silver has staged a strong rally, climbing 32.93% as of this writing (YTD through 5/27/2024),” Smirnova wrote in Sprott’s latest silver report. “Silver has been playing catch up to gold's rally, with both metals buoyed by the prospect of easing monetary policy in the U.S., rising geopolitical turmoil in the Middle East and central bank buying, particularly from China. Silver faced several headwinds in 2023, most notably rising interest rates and slower economic growth in both the U.S. and China.”

Smirnova noted that despite a robust physical silver market in 2023, Western investment demand was weak, as evidenced by silver ETFs selling 50 million ounces over the year, or 6% of total holdings. “Looking ahead, we expect silver prices to continue to improve, driven by lower interest rates, more robust physical investment, ETF purchases and increased industrial demand,” she said.

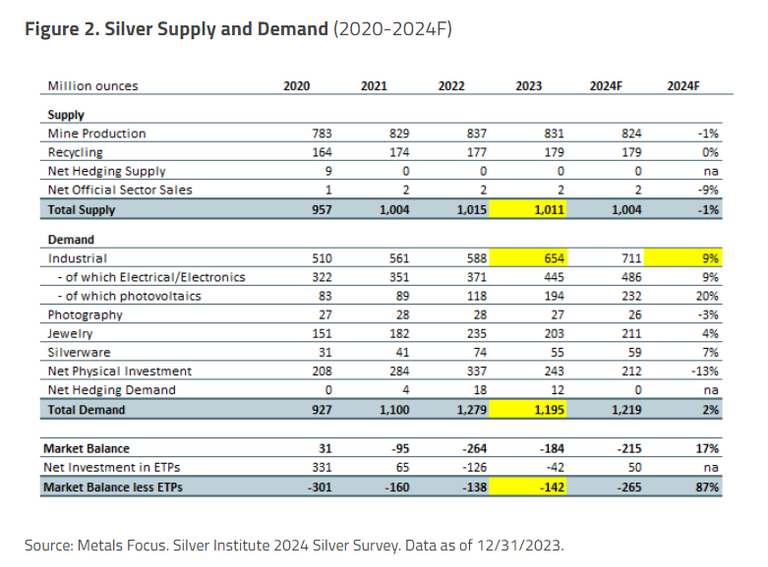

“For the third year, silver demand significantly exceeded supply in 2023 as demand for industrial applications continued to increase,” Smirnova said. “Much of this growth has been driven by photovoltaics, and overall, industrial demand is forecast to rise by 9% this year to a new record high.”

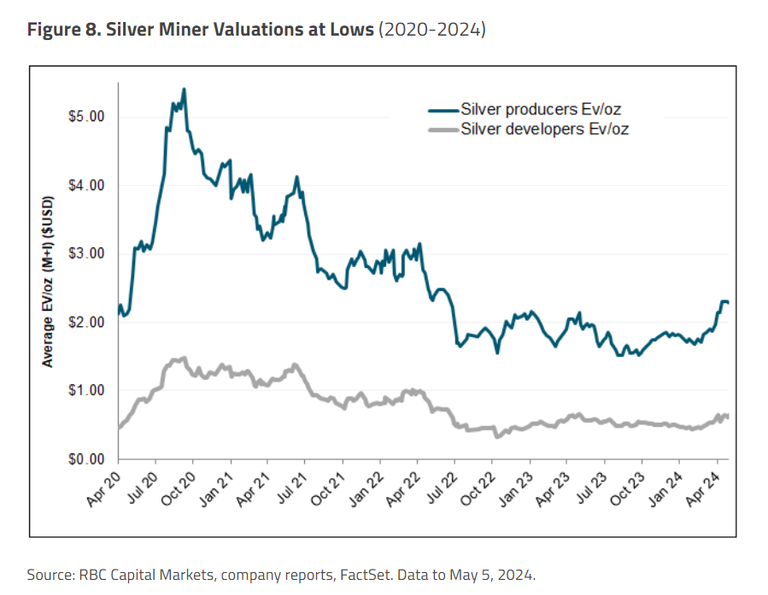

Smirnova added that this dynamic will support silver miners even as it boosts the gray metal’s market price.

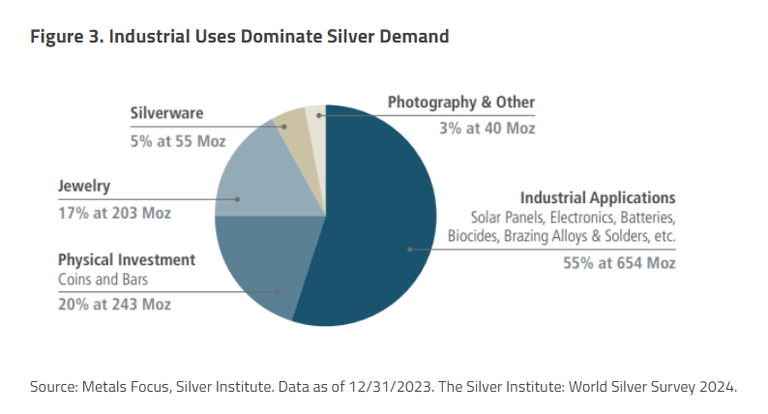

Smirnova pointed out a fundamental shift in demand for silver, which she believes is likely to continue.

“Historically, half of the demand for silver has been industrial, and the remaining half has included investment and investment-like categories such as jewelry, silverware, and actual bar and coin investment,” she wrote. “In recent years, however, the balance has been shifting in favor of industrial demand, which now represents 55% of the total demand for silver,” which would represent “an 11% jump from 2022.”

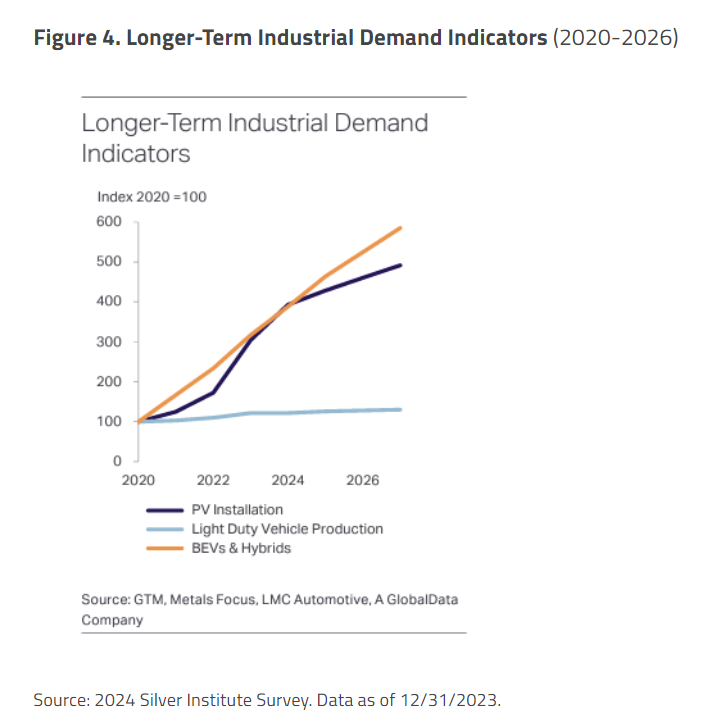

Sprott sees three major areas for growth in industrial demand for silver in the coming years: The solar energy industry, the automotive sector, including electric vehicles (EV) and their associated infrastructure, and artificial intelligence (AI).

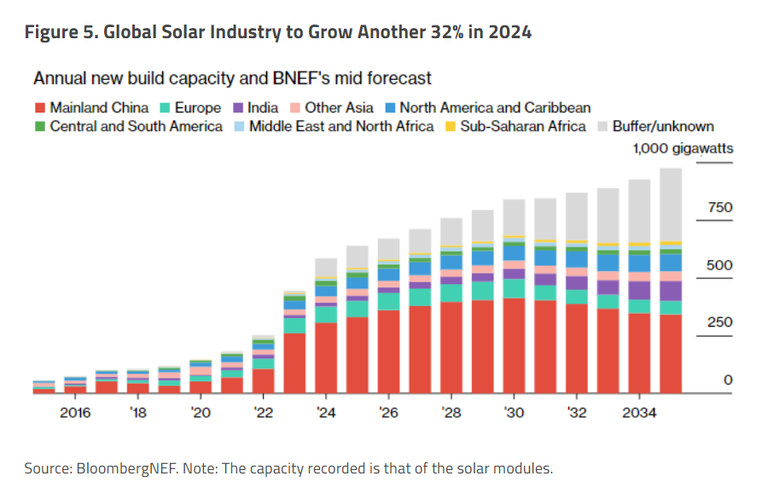

Smirnova said that the solar energy and photovoltaics sector is absorbing 40% of global investment in energy transition manufacturing, “reaching $80 billion in 2023,” and Sprott believes solar demand for silver will “continue to increase, possibly by 170% by 2030.”

Already, solar has nearly tripled its share of silver demand in the last 10 years. “In 2023, photovoltaics consumed 142 million ounces of silver, or 13.8% of total silver usage worldwide, up from nearly 5% in 2014,” she wrote.

And even as manufacturers work to reduce the quantity of silver required in solar panels, the massive scaling up in panel production should see overall silver demand from the sector continue to increase at a strong rate. “According to BloombergNEF, the global solar industry is expected to grow 32% in 2024,” she said.

Electric vehicles and charging infrastructure are the second area where Sprott projects significant increases in silver demand on the back of massive sales growth for the vehicles themselves.

“After breaking through the one million mark in the U.S. in 2023, an increase of 52% from the previous year, EV sales are expected to power through 2024,” Smirnova said. “Global EV sales are expected to crack 17 million units sold, and the IEA predicts that by 2035, every other car sold globally will be electric.”

She noted that the automotive industry already uses around 80 million ounces of silver per year, and this number is expected to increase to 90 million by 2025. “Silver loadings have been rising over the past few decades and are expected to increase even more in the future,” Smirnova wrote. “In hybrid vehicles, silver use is higher at around 18 to 34 grams per light vehicle, while battery electric vehicles (BEVs) are believed to consume in the range of 25 to 50 grams of silver per vehicle. The move to autonomous driving should dramatically escalate vehicle complexity, requiring even more silver consumption.”

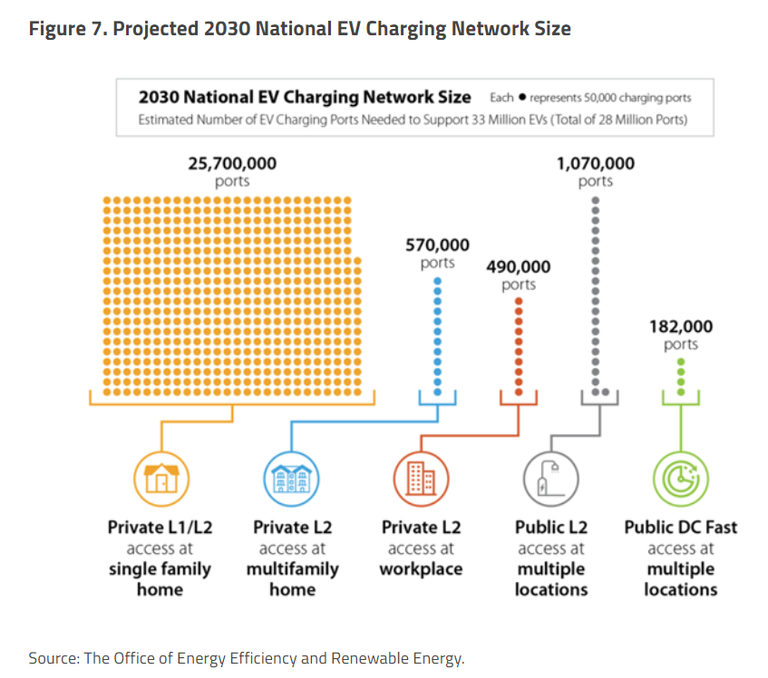

While higher loadings are the primary driver for increased automotive silver demand, the gray metal is also required for charging stations, increased electric power generation and other infrastructure to support electric vehicles. “The National Renewable Energy Laboratory estimates that by 2030, 28 million EV charging ports will be needed to support the fleet of EVs in the U.S.,” she said.

The third industrial area that will materially increase silver demand is the build-out of AI infrastructure, as silver is used in power generation and transmission, as well as in the data centers themselves.

“Silver has the lowest electrical resistance among all metals at standard temperatures and is crucial in many electronic applications, including electrical contacts in switches, transformers, relays and capacitors,” Smirnova wrote. “Additionally, silver will be needed in many forms in the transportation industry, such as semiconductors, harnesses, controls, fuses, switches, electronic control units, infrared radars, laser radar (LIDAR), motion sensors and displays. Healthcare will also play a role, with silver being necessary for wearable devices.”

And while the demand side of the equation continues to grow, the supply side has been stagnant or shrinking. “Silver mine supply has been essentially flat over the last 10 years and declined 1% in 2023,” she noted. “Going forward, mining production is expected to decline another 1% in 2024 to 823 million ounces, the lowest level since 2020 when the Pandemic shut down mines. Recycling or scrap supply is also expected to remain flat this year, leading to a 1% decline in total supply.”

There are also numerous problems that impact silver production and further constrain supply. “Silver mine production is prone to disruptions and unforeseen events, which have culminated in the current supply shortage,” Smirnova wrote. “Additionally, most silver mines are focused on other metals, with silver as a by-product. Only 28.3% of mines that produce silver are primary silver mines.”

Implications for Supply/Demand

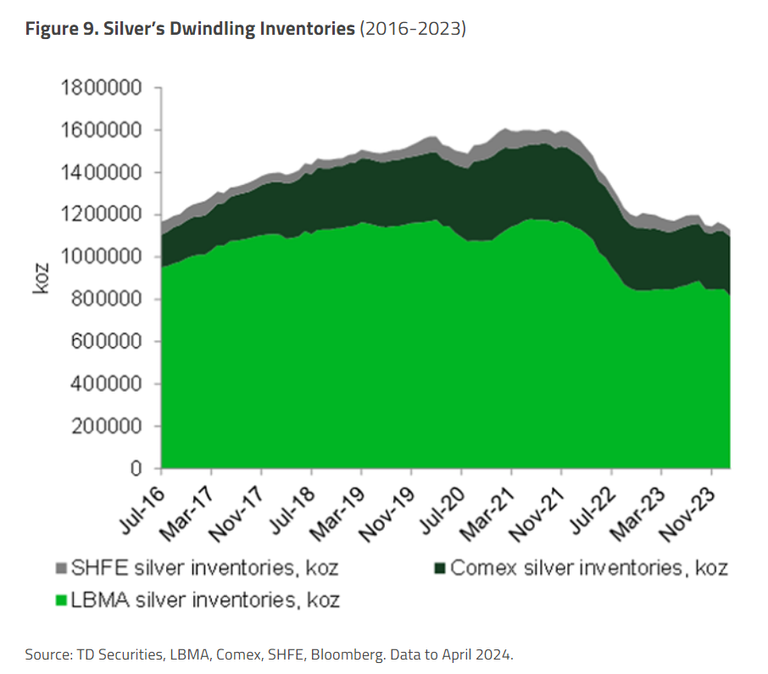

Silver’s supply/demand imbalance is expected to worsen, with the supply deficit projected to rise by 17% in 2024, while industrial demand will increase by 9%. “We have already seen a decline of ~480 million ounces of silver held on the major exchanges since February 2021,” she pointed out.

“One can only postulate the amount of time it will take to deplete the remaining ounces, given the metal’s precarious supply/demand situation,” she concluded. “We believe the global energy transition will be highly positive for silver, leading to much higher prices for silver bullion and equities.”

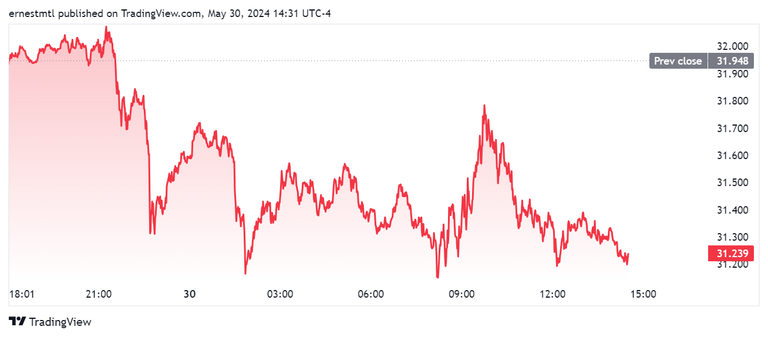

Spot silver was trading above $32 per ounce overnight, but it pulled back during the European and North American sessions, last trading at $31.239 per ounce for a loss of 2.22% on the 24-hour chart.

This article originally appeared on Kitco News