The Great Shortening: Why ‘Domestic Processing’ Can Mean Scarcity by Design

They’re Not Just Moving Factories — They’re Tightening the Grip

There’s a silent revolution happening in the background of the financial system. The government isn’t just watching global supply chains; it’s rewiring them. Bloomberg has been tracking this shift: critical mineral refining, especially for rare earths, lithium, and silver-linked industries, is being reshored — brought back under U.S. control.

The public framing is national security. The hidden consequence? Control over supply and allocation.

What was once subject to international market forces is now being routed through fewer, domestically controlled chokepoints. That’s not just a policy change. That’s a blueprint for selective scarcity.

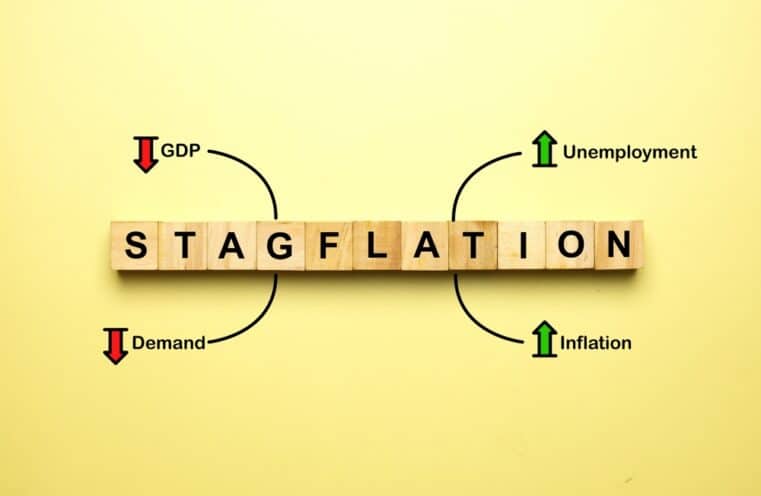

Verifiable Data, Clear Threats

The International Energy Agency (IEA) has flagged supply-chain concentration risks around strategic minerals. And Bloomberg’s ongoing coverage shows U.S. authorities are building out domestic refining capacity to reduce dependency on China and other geopolitical rivals.

What they don’t tell you: as the chain shortens, the number of decision-makers shrinks. With fewer sellers and less redundancy, it's easier than ever to implement:

- Rationing based on industrial priorities

- Export restrictions in times of “strategic need”

- Price distortions through subsidies or penalties

Once the state is in control of the spigot, you’re not at the front of the line.

Shorter Chain, Bigger Spreads

In the new compressed supply chain, “domestic” doesn’t mean abundant. In fact, it means the opposite. As refining and processing are re-nationalized, the friction shifts from foreign ports to federal priorities.

Here’s what that looks like for investors and savers:

- Higher premiums on physical silver and gold. When allocation gets political, retail buyers pay the price.

- Longer delivery times. Reshored facilities have lead times measured in years — not months.

- Paper-vs-physical spreads widen. Futures markets may reflect policy-distorted prices, while real metal disappears from shelves.

This is scarcity by design. And if you think you’ll be able to “just buy some later,” you’re not seeing the setup.

Why This Matters in 2026 — and Beyond

The shift is happening now, but the impact will be felt in the next stress cycle. Imagine a geopolitical flare-up or a financial panic where domestic supplies are “reprioritized” for defense, infrastructure, or energy.

You won’t be able to outbid the U.S. government for strategic metals — and you certainly won’t be able to access supply they’ve already locked down.

This isn’t fear-mongering. It’s logistics. And it's already playing out.

There’s a Window. It’s Closing.

Right now, you still have access to physical assets. You can still buy silver, gold, and other strategic metals at premiums that reflect market supply — not government allocation.

But that window is narrowing. The fewer links in the chain, the faster it closes.

That’s why I created The Digital Dollar Reset Guide — to help people like you get ahead of the engineered scarcity and prepare for the financial control grid being built in plain sight.

Download the Free Digital Dollar Reset Guide

Inside the guide, you’ll discover:

- How supply chain “shortening” leads to domestic price shocks.

- What metals are most exposed to policy-driven allocation.

- How to position yourself now to avoid being priced out or locked out.

🛡️ Download The Digital Dollar Reset Guide Here »

Don’t wait until the supply is gone or the rules change. In this system, those who act last get nothing.

— Bill Brocius

Dedollarize News