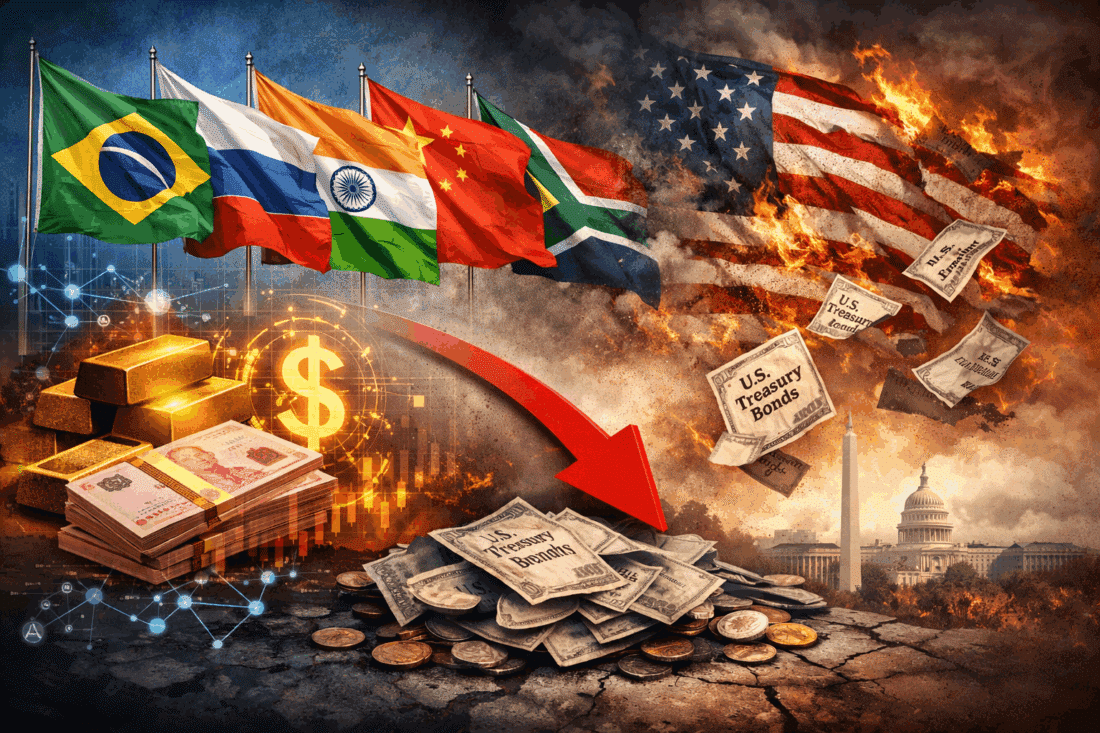

Trump’s Tariffs on BRICS Nations: The Spark That Ignites the Next Global Crisis?

Trump’s New Tariffs Signal the End of Trade as We Know It

In a move that shocked markets and rattled international relations, President Donald Trump has enacted a sweeping 25% tariff on imports from China, Mexico, and Canada. While Mexico and Canada have secured a temporary delay, Beijing wasted no time in striking back with retaliatory measures. And with BRICS nations increasing their de-dollarization efforts, this confrontation is about to evolve into something far worse than the 2018 trade war.

It’s no coincidence that Trump’s latest tariffs target countries with growing economic alliances outside the U.S. financial system. BRICS nations, particularly China, have steadily reduced their reliance on the dollar, increasing trade settlements in local currencies by over 30% in just five years. This shift threatens U.S. economic dominance, and Washington is now responding the only way it knows how—economic warfare.

But here’s the reality: these tariffs won’t hurt BRICS nearly as much as they’ll hurt American consumers.

The Hidden Cost of Tariffs: American Households Will Pay the Price

China accounts for more than 15% of all U.S. imports, and the total trade volume between the two nations surpasses $650 billion annually. Slapping a 25% tariff on those imports won’t “punish” China—it will punish every American household that depends on affordable goods.

Inflation is already wreaking havoc on the average American. These tariffs will only accelerate price increases across everything from electronics to food to essential household goods. If the Biden-era inflation crisis wasn’t bad enough, Trump’s tariffs could push the economy into an outright stagflationary spiral.

And let’s not forget precedent. Trump’s 2018 trade war with China cost businesses and consumers over $316 billion in just two years. This time, the stakes are even higher, with BRICS controlling 45% of global oil production and holding 35% of the world’s GDP. If you think China and its allies won’t retaliate in force, you haven’t been paying attention.

A Looming Global Trade War with No Off-Ramp

The diplomatic fallout from these tariffs is inevitable. BRICS nations will likely challenge them through the World Trade Organization (WTO) and the International Chamber of Commerce, leading to a drawn-out legal battle. But make no mistake—retaliation won’t wait for bureaucratic red tape. China has already restricted key exports in the AI and semiconductor sectors, hitting the U.S. where it hurts.

Meanwhile, BRICS continues to expand its economic influence, onboarding new members and pushing forward with alternative financial systems designed to bypass U.S. sanctions entirely. As Washington continues to provoke, the global shift away from dollar dominance is accelerating.

So what’s your plan?

If history tells us anything, it’s that these trade wars won’t just remain economic battles—they’ll spill into financial markets, consumer prices, and even political instability. That’s why you need to take action now to protect your assets from the fallout.

Bill Brocius has been warning about this for years, and his book, End of Banking As You Know It, lays out exactly how to safeguard your wealth in times like these. For those who want even deeper insights, his Inner Circle newsletter offers exclusive, real-time analysis on the next moves in the financial war.

And if you haven’t already, download our free guide, “7 Steps to Protect Your Account from Bank Failure” before it’s too late. Get it here:

🔗 Download the Free Guide Now

Don’t wait for the next round of economic chaos to catch you off guard. Prepare now.