Wall Street Sabotage: Who’s CRASHING Gold & Silver?

Why Wall Street Crashing Gold and Silver Isn’t an Accident

Let’s cut the crap: someone big is trying to crash gold and silver right now—and they're doing it in plain sight.

Don Durrett’s recent comments lit a match under this tinderbox. He put it bluntly: gold and silver are being smashed by a deliberate force. And it’s not just a conspiracy theory—it’s part of a much larger and more dangerous financial game being played in the backrooms of New York and Washington. You feel like the rules are rigged? That’s because they are.

But here’s the thing: they’re fighting a losing battle.

Let me walk you through what’s happening—and more importantly, what you need to do about it.

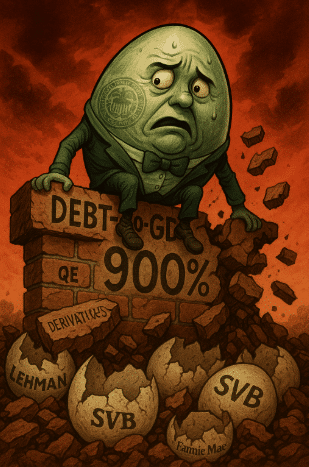

The "Humpty Dumpty" Crash Is Coming—And It Ain’t Going Back Together

October 2025 may go down in history as the month the system broke. You might remember the dot-com crash, 2008, or even the pandemic panic. But what we’re facing now isn’t just another downturn. It’s a collapse. We’re talking about a “Humpty Dumpty crash”—and this time, there’s no putting it back together.

Why?

Because we’ve hit critical mass. The U.S. debt-to-GDP ratio has skyrocketed past 900%. That’s not a typo. Our national debt has been growing at 8% a year since 2000. GDP? Barely 4%. That’s like earning $40K a year but racking up $90K in credit card debt annually.

Eventually, the lender stops lending. And the borrower? Well, the borrower gets crushed.

The Hilarious—but Deadly—Gold Game the Elites Are Playing

Right now, there’s a hilarious contradiction playing out in front of us—if it weren’t so dangerous.

Central banks around the world are gobbling up gold like it’s going out of style. Why? Because they know fiat currencies are on their last leg. But meanwhile, over in the U.S., the Federal Reserve and New York banks are dumping gold like it's garbage, trying to suppress prices and maintain the illusion that everything’s under control.

It’s madness. There’s $12 trillion in “hot money” flooding into Wall Street—money with no long-term loyalty, just looking to ride the wave and cash out before the crash. That’s 60% of the market.

They know the game is rigged. But here’s the kicker: that game is about to end.

Gold to $8,000? Silver to $150? It’s Already in Motion

Let’s talk brass tacks. Gold and silver prices are not reflecting reality. They're being pushed down by paper contracts, naked short selling, and a system designed to keep the dollar on life support.

But it won’t last. The fundamentals are too strong, and the pressure is building.

- Gold is in a bull market that quietly began in December 2019. That bull is still running. Experts like Durrett project gold could hit $8,000—and in extreme scenarios, even $78,000.

- Silver? Even more explosive. Current projections land between $100 to $150 per ounce, riding the same bull wave.

- The HUI Index, which tracks gold mining stocks, has surged 137% year-to-date. And it’s still just heating up, potentially tripling from 600 to 1,800.

Folks, this isn’t hopium. This is history repeating itself.

China’s Big Exit: The World Is Ditching the Dollar

While the U.S. keeps printing and spending like there’s no tomorrow, China’s been quietly dumping U.S. Treasury bonds for over a decade—going from $1.5 trillion in holdings to under $800 billion.

They see the writing on the wall. The dollar isn’t what it used to be. And when a superpower like China loses faith in your currency, you’re in trouble.

This isn’t just about trade. It’s about global power shifting. And it’s happening while Americans are distracted with headlines about Taylor Swift and TikTok drama.

War, AI, and a Hollowed-Out Middle Class: America’s Decline Is Here

Let’s be honest: the American middle class—the backbone of this country—has been hollowed out since the 1970s. It’s no accident. It's policy. Offshoring jobs, endless wars, exploding debt, and now, AI replacing workers left and right.

We were told this would make life better. But look around: lower wages, fewer jobs, higher prices, and a broken quality of life.

And now we’re marching into what could be a “lost decade”, just like Japan in the 1990s. Except Japan didn’t have $34 trillion in debt and a crumbling empire.

The Next Two Years Will Be Brutal—Here’s How to Survive It

I don’t like fear-mongering, but I’ll tell you straight: the next two years are going to be awful. Economic stagnation. Market crashes. Supply shocks. Currency devaluation. You name it.

But here’s the good news: you’re not powerless.

You can opt out of this broken system. You can protect yourself with real assets like gold and silver—things that hold value no matter what Wall Street or Washington throws at us.

I've seen what happens when folks get caught unprepared. I lived through the 1980s inflation crisis. I watched clients lose everything in 2008. And I promised myself I’d never let good people go into the fire blind again.

So here’s your action plan:

🛡️ Take Action Before the Next Shoe Drops

Don’t wait until the headlines scream “CRISIS!” to make your move. Do it now:

✅ Download Bill Brocius’ FREE eBook: "Seven Steps to Protect Yourself from Bank Failure."

✅ Subscribe to Dedollarize’s Weekly Insights for up-to-the-minute guidance on protecting your wealth with precious metals. Click here to subscribe.

✅ Start converting your cash into gold and silver. Even a small position can shield your savings.

Final Thoughts

The system is cracking. The elites know it. That’s why they’re hiding behind gold while distracting us with manipulated prices and false confidence.

Don’t be fooled.

Be early. Be smart. Be protected.

Your financial survival could depend on it.

— Frank Balm