When Politics Meets the Central Bank: Why the Powell Pushback Matters Far Beyond Washington

The Political Assault on the Fed: A Sign of the Times

Jerome Powell, Chair of the Federal Reserve, is under fire — not for inflation policy or interest rate manipulation, but for a building renovation.

Yes, you read that right. In recent days, a swirl of controversy erupted around alleged criminal wrongdoing tied to cost overruns during the renovation of the Federal Reserve's headquarters. The implications of this dust-up, however, reach far beyond construction budgets or Capitol Hill theatrics. What’s playing out is a dangerous convergence of politics and central banking — and it signals a broader destabilization already in motion.

For decades, the Federal Reserve operated with the illusion of apolitical neutrality. But the gloves are off. The Fed is now caught in the crosshairs of a politicized battle for control — and it’s not just about Powell. It's about who gets to steer the future of money.

The Central Bank Is No Longer Above the Political Fray

The Powell incident shatters the long-held belief that the Fed is a sacrosanct institution, immune to the partisan warfare that engulfs the rest of Washington. With Trump allies exploring criminal charges against Powell, and high-ranking Republicans publicly defending him within hours, the event reveals something vital: The central bank is now fully embedded in the political battlefield.

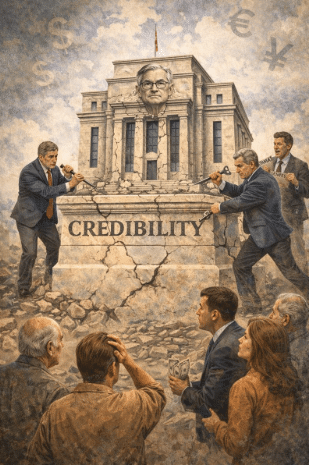

Yes, Powell's aggressive pushback worked — for now. Political allies circled the wagons, denouncing the probe and arguing for congressional oversight instead of prosecution. But the damage is done. Once a central bank becomes a political football, its credibility — and the stability of the entire monetary system — starts to erode.

Why This Matters to Every American (and Not Just Market Watchers)

You don’t need to follow Federal Reserve policy to feel the tremors of this event. Here’s why it matters to you:

- Credibility Crisis: When political factions target the Fed, global markets take notice. Trust in monetary policy declines.

- Currency Instability: Central bank credibility underpins the value of fiat currency. Undermine that trust, and you weaken the dollar.

- Monetary Overreach: As the Fed expands its role into digital currency, climate policy, and even social equity, resistance is growing — not just from watchdogs, but from within the government itself.

When political attacks and bureaucratic overreach collide, the fallout affects every investor, homeowner, saver, and retiree.

The Deeper Rot: Cost Overruns and Secrecy

Let’s not ignore the core issue. The Powell renovation controversy began with real concerns: runaway costs and a lack of transparency.

The Fed — the most powerful financial institution on Earth — still operates behind a thick curtain. When its leaders dodge questions or spin narratives, they invite scrutiny. Accountability is not the enemy of independence. But weaponizing that accountability for political gain? That’s a different game altogether.

This moment should have triggered honest questions about how the Fed manages taxpayer-backed assets. Instead, it’s devolved into political theater — with Powell the starring character.

A System Under Pressure — and Nearing Its Breaking Point

The Powell episode is not isolated. It echoes a global trend: central banks are under siege. From Europe to Asia, institutions once seen as above the fray are now political targets, scapegoats, and pawns in the next phase of global realignment.

What makes this more dangerous in the U.S. is the timing. As the Federal Reserve inches closer to launching a central bank digital currency (CBDC) and deeper into surveillance-driven monetary tools, public trust is eroding just when centralization is accelerating.

That’s not just inconvenient — it's destabilizing.

What Comes Next — and Why You Need to Be Ready

This isn't about Powell. It's not about Trump. It's not about a building in D.C.

It’s about a system in flux, a currency under pressure, and a central bank no longer protected from political storms.When the guardians of monetary stability themselves become targets — or worse, political actors — the risks to your financial freedom multiply.

There’s a reset underway. Not tomorrow. Not next year. But it’s coming — and only those who see the signs will be ready.

Your Next Step: Don’t Wait to Be Surprised

If you're reading this, you already understand something is wrong. The veneer is cracking, and the battles behind closed doors are now spilling into public view.

Download my free report — The Digital Dollar Reset Guide — to learn how to shield your wealth, protect your privacy, and prepare for the monetary system that’s coming next.

You can’t vote your way out of what’s coming. But you can opt out — if you act now.